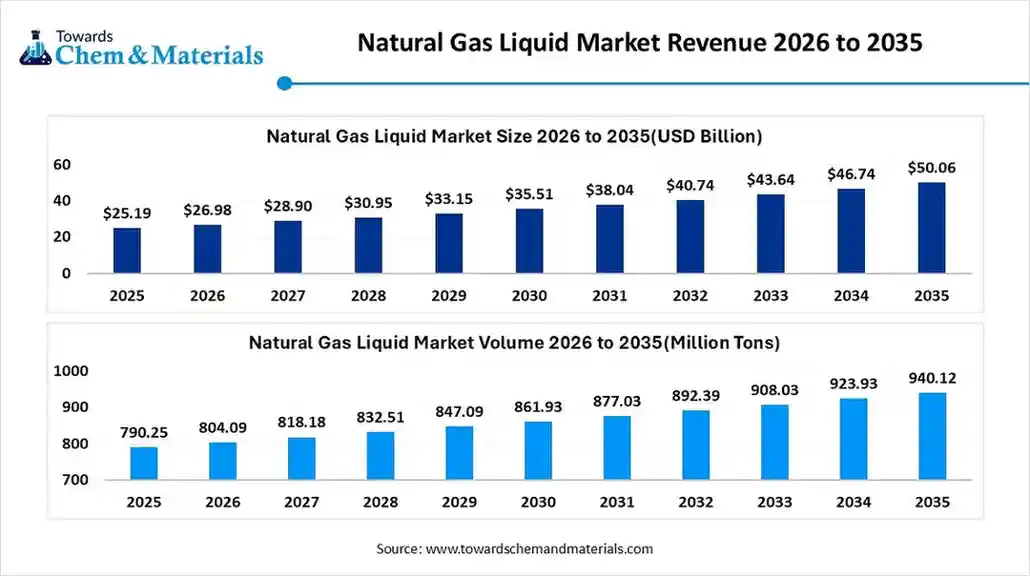

Natural Gas Liquid Market Volume to Worth 940.12 Million Tons by 2035

According to Towards Chemical and Materials, the global natural gas liquid market size was estimated at USD 25.19 billion in 2025 and is predicted to increase from USD 26.98 billion in 2026 and is projected to reach around USD 50.06 billion by 2035, The market is expanding at a CAGR of 7.11% between 2026 and 2035.

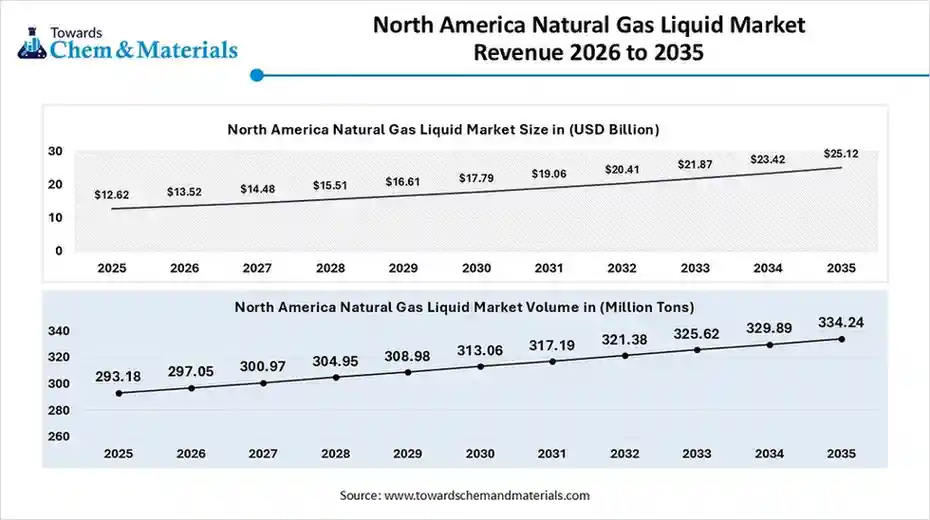

Ottawa, Jan. 05, 2026 (GLOBE NEWSWIRE) -- The global natural gas liquid market size was estimated at USD 25.19 billion in 2025 and is expected to increase from USD 26.98 billion in 2026 to USD 50.06 billion by 2035, growing at a CAGR of 7.11%. In terms of volume, the market is projected to grow from 790.25 million tons in 2025 to 940.12 million tons by 2035. exhibiting at a compound annual growth rate (CAGR) of 1.75% over the forecast period 2026 to 2035. The North America dominated natural gas liquid market with the largest volume share of 37.10 % in 2025. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6117

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Natural Gas Liquid Market Report Highlights

- By region, North America led the natural gas liquid market with the largest volume share of over 37.10% in 2025.

- By region, Asia Pacific is growing at the fastest CAGR in the market during the forecast period due to the growing electricity demand.

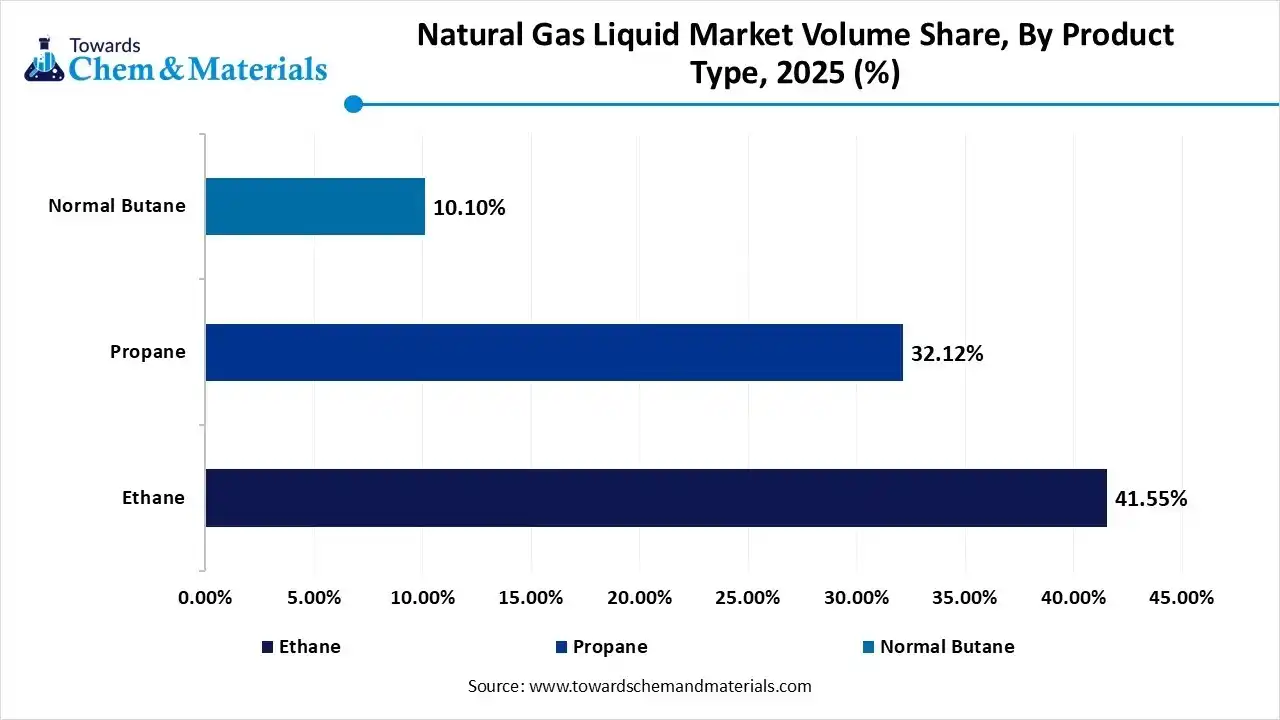

- By product type, the ethane segment led the market with the largest volume share of 41% in 2025.

- By source, the natural gas processing plants segment led the market with the largest volume share of 85% in 2025.

- By application, the petrochemical feedstock segment accounted for the largest volume share of 57% in 2025.

- By end user, the industrial sector segment dominated with the largest volume share of 48% in 2025.

What is Natural Gas Liquid: Bridging the Gap Between Gas and Liquid Energy Sources

Natural Gas Liquids (NGL) are versatile hydrocarbons serving as a vital bridge fuel between carbon-heavy fossil fuels and renewable energy. By condensing raw natural gas into high-density, transportable liquids. NGL provides a cleaner alternative for heating, vehicle fuels, and petrochemical feedstocks while utilizing existing infrastructure.

As a flexible, low-emission resource, they maintain energy security during the global shift toward wind and solar power. Ultimately, NGL offers a reliable solution that balances immediate industrial demands with long-term sustainability goals.

Government Initiatives for Natural Gas Liquids:

- U.S. "Energy Dominance" Agenda: The U.S. government has reversed prior pauses on liquefied natural gas (LNG) export authorizations to accelerate infrastructure build-out and solidify its position as the world's top exporter.

- India’s "One Nation One Gas Grid": This initiative aims to expand the National Gas Grid Pipeline and City Gas Distribution network to increase the share of natural gas in India's energy mix to 15%.

- EU Gas Storage Regulation Extension: The European Union has extended mandatory gas storage targets through 2027, requiring member states to fill facilities to 90% capacity annually to ensure winter energy security.

- China’s Energy Security Strategy: China is aggressively expanding its regasification infrastructure and domestic pipeline connections to provide clean energy access to millions more citizens by 2030.

-

Qatar’s North Field Expansion: Backed by state-led investment, this initiative is significantly increasing global NGL and LNG supply while integrating large-scale carbon capture (CCUS) to reduce the emissions intensity of production.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6117

Natural Gas Liquids Market Report Scope

| Report Attribute | Details |

| Market size and Volume in 2025 | USD 26.98 Billion / 804.09 Million Tons |

| Revenue forecast in 2035 | USD 50.06 Billion / 940.12 Million Tons |

| Growth rate | CAGR of 7.11% from 2026 to 2035 |

| Actual data | 2019 - 2025 |

| Forecast period | 2026 - 2035 |

| Quantitative units | USD in million/billion/ Volume and CAGR from 2026 to 2035 |

| Report coverage | Revenue Forecast, competitive landscape, growth factors and trends |

| Segments covered | Product Type Insights, Source Insights, Application Insights, End-User Insights, Regional Insights |

| Regional scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Country Scope | U.S.; Canada; Mexico; Germany; UK; Italy; Spain; France; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

| Key companies profiled | ExxonMobil Corporation; Chevron Corporation; Royal Dutch Shell plc; BP plc; ConocoPhillips; TotalEnergies SE; Enterprise Products Partners LP, Eni S.p.A.; Occidental Petroleum Corporation; Saudi Aramco |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

What are the Major Trends in the Natural Gas Liquid Market?

- Stringent Environmental regulations: This trend shapes the NGL market, with a focus on reducing greenhouse gas emissions and promoting carbon capture and energy efficiency. The stricter regulations on the production and use of NGL are due to their carbon footprint.

- Shift toward Petrochemical Feedstocks: The shift is powered by rapid urbanization, population growth, and growing demand for plastics and synthetic materials. NGL are increasingly used as feedstocks in the manufacture of biofuels and other renewable energy applications

- Decarbonization Efforts: To remain worthwhile in a net-zero future, the industry is increasingly accepting Bio-LNG (liquid biomethane), carbon capture at extraction points, and using green electricity for fractionation to power the production of lower-emission fuels for heavy-duty transportation and maritime bunkering.

- Robust Industrial Expansion: NGL are increasingly used as a cleaner alternative to coal and oil for heating, power generation, and drying activities in industrial processes. Significant investment in NGL storage and pipeline building in the market

Fuelling the Future: Innovation and AI Drive Growth in the Natural Gas Liquid Industry

The natural gas liquid (NGL) market is evolving rapidly, driven by precision recovery techniques like cryogenic processing and modular liquefaction, which have become global standards for enhanced extraction efficiency. AI plays a vital role by identifying optimal drilling sites and offering real-time control during complex fractionation, significantly improving reservoir productivity. With smart sensing integration, the industry maximizes reservoir yields while reducing emissions, aligning high-efficiency production with global sustainability goals.

Market Opportunity

Can Emerging Economies Reshape the Natural Gas Liquid Industry?

Emerging economies are transforming the NGL market in urbanization and industrial growth, increasing energy demand, and infrastructure development. These countries are shifting away from traditional fuels, adopting NGL as a cleaner alternative for heavy-duty transportation and as a key feedstock. By utilizing innovative green bonds and blended finance for transition energy projects, these nations act as major drivers of global market expansion.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6117

Natural Gas Liquid Market Segmentation Insights

Product Type Insights

How did the Ethane Product Segment hold the Largest Share of the Natural Gas Liquid Market?

Ethane has become the largest product segment in the global NGL market due to its role as a primary feedstock for ethylene production, essential for manufacturing plastics, antifreeze, and detergents. The development of the high availability of shale gas, advanced extraction and fractionation technologies has improved ethane recovery and processing, ensuring a stable and cost-effective supply.

The isobutane product segment is projected to expand rapidly due to stricter environmental regulations, innovation in natural gas processing, and increasing demand in the petrochemical and refrigeration industries. The key focus is on sustainability, technological innovation, and reducing environmental impact, driving the isobutane market.

Natural Gas Liquid Market Volume and Share, By Product Type 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | ||

| Ethane | 41.55 | % | 328.35 | 415.91 | 2.39 | % |

| Propane | 32.12 | % | 253.83 | 283.07 | 1.10 | % |

| Normal Butane | 10.10 | % | 79.82 | 89.78 | 1.18 | % |

| Isobutane | 6.12 | % | 48.36 | 56.88 | 1.63 | % |

| Natural Gasoline [Pentane Plus] | 10.11 | % | 79.89 | 94.48 | 1.69 | % |

Source Insights

How do Natural Gas Processing Plants Segment Dominate the Natural Gas Liquid Market?

The natural gas processing plant segment dominated the market, with a focus on efficiency, innovation, and sustainability. Its main goal is to remove impurities and non-methane hydrocarbons to produce pipeline-quality dry natural gas. This includes separation, contaminant removal, recovery, and NGL fractionation. Adoption of digital tools, automation, and rising demand for industrial heating and diverse applications are transforming the market.

The crude oil refineries segment is anticipated to grow fastest due to petrochemical integration and the availability of shale gas and feedstock. The focus on refinery integration and Gas-to-Liquid technology is driving clean energy expansion. The natural gas processing plant is a key source for crude oil refineries, boosting the investment that leads to market growth.

Application Insights

Which Application Dominated the Natural Gas Liquid Market?

The petrochemical feedstock segment has dominated the market, driven by its integral role in supplying raw materials for the chemical industry, impacting various sectors such as packaging, automotive, and construction. The petrochemical feedstock is driving the demand for ethane and propane in refineries and the petrochemical industry.

The transportation fuel segment is expected to experience the fastest growth during the forecast period, driven by its reliance on NGL for low-emission transportation solutions. The emphasis on clean energy sources and the expanding application of LNG in various industries is driving the market. Government initiatives promoting cleaner energy sources are instrumental in propelling this growth.

End-User Insights

Which End-User Segment Leads the Natural Gas Liquid Market?

The industrial sector leads the NGL market, increasingly adopting NGL as a cleaner, more cost-efficient alternative to traditional fossil fuels. NGL offers higher energy efficiency and lower emissions than coal and oil, supporting industrial efforts to reduce carbon footprint and meet stricter environmental standards.

The commercial sector is projected to grow fastest during the forecast period, driven by rising demand for heating, cooking, and energy efficiency. Government support for energy transition in commercial spaces and increasing energy needs require NGL. The growing use of detergents and water heating in commercial settings also boosts demand. NGL is used as fuel in furnaces for heating, cooking, and in several heating systems, laundry dryers, grills, and portable stoves.

Regional Insights

The North America natural gas liquid market was estimated to be USD 12.62 billion in 2025 and is projected to reach USD 25.12 billion by 2035, at a CAGR of 7.13% during the forecast period. By volume, the market is projected to grow from 293.18 million tons in 2026 to 334.24 million tons by 2035. growing at a CAGR of 1.32% from 2026 to 2035.

North America dominates the market due to its abundant shale resources, unconventional drilling techniques with advanced technological infrastructure, and strong domestic demand for ethane. North America leads in production with low extraction costs and major exporters that meet global demand, attracting investment and strategic partnerships with market players. Overall, significant demand makes this region the powerhouse of the global NGL market.

U.S. Natural Gas Liquid Market Trends

The U.S. market is experiencing steady growth driven by rising production from shale basins such as the Permian, Eagle Ford, and Marcellus. Strong demand from the petrochemical sector, particularly for ethane as a feedstock in ethylene production, continues to support market expansion. The U.S. is also strengthening its position as a leading global exporter of NGLs, with increasing shipments of propane and ethane to international markets.

Global Natural Gas Liquid Market Volume and Volume Share, By Region, 2025 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 | |||

| North America | 37.10 | % | 293.18 | 329.89 | 1.32 | % | 35.09 | % |

| Europe | 10.23 | % | 80.84 | 89.78 | 1.17 | % | 9.55 | % |

| Asia Pacific | 27.33 | % | 215.98 | 273.86 | 2.67 | % | 29.13 | % |

| South America | 5.23 | % | 41.33 | 46.07 | 1.21 | % | 4.90 | % |

| Middle East & Africa | 20.11 | % | 158.92 | 200.53 | 2.62 | % | 21.33 | % |

Asia Pacific Natural Gas Liquid Market Trends

Asia Pacific is anticipated to grow during the forecast period in the market. The huge demand from manufacturers as feedstocks for producing chemicals, plastics, and synthetic rubber. The demand is driven by government mandates for cleaner natural gas for power generation and rapid urbanization for household cooking and heating. The growing industrial capacity across this region is positioning APAC as a major contributor to a growth hub in the global NGL industry.

India Natural Gas Liquid Market Trends

India's market is gradually expanding as the country strengthens its focus on cleaner energy sources and downstream petrochemical development. Rising domestic natural gas production, along with improved gas processing and fractionation capacity, is increasing the availability of NGLs such as propane, butane, and pentane.

Energy Growth: China's Fueling Role in NGL Production

China is a major contributor to the market. The strong emphasis on coal replacement and enhancing household wealth increases demand for NGL. The increased production of propylene and the government backing for cleaner fuels create demand for NGL. The surge of manufacturing operations and the expansion of NGL infrastructure help market growth. The development of unconventional gas reserves and regasification capacity expansion supports the overall market growth.

- China exported $342M of propane, liquefied in 2024.

Europe Natural Gas Liquid Market Trends

Europe is growing at a notable rate in the market. The focus on lowering reliance on Russian gas and shifting towards cleaner fuel alternatives increases the production of NGL. The continued growth in petrochemical demand and the increasing and increased use of lightweight material in automotive production increases the adoption of NGL. The heavy investment in expanding NGL import terminals and supportive regulations for NGL support the overall growth of the market.

United Kingdom Contribution to the NGL Sector

The United Kingdom plays a pivotal role in the market. The rapid growth in the petrochemical industry and the increasing use of cleaner fuels in transportation sectors increase demand for NGL. The increased adoption of cleaner energy resources in the residential sector and well-developed import infrastructure increases demand for NGL. The ongoing development in extraction technology supports the overall growth of the market.

Power Progress: Saudi Arabia’s Role in Natural Gas Liquids

Saudi Arabia is growing substantially in the market. The rise in the development of low-carbon solutions and expanding industrial activities increases demand for NGL. The focus on oil replacement in electricity generation and growing projects like Jafurah unconventional reserves boosts the production of NGL. The focus on building midstream infrastructure and the manufacturing surge support the overall market growth.

South America Natural Gas Liquid Market Trends

South America is growing significantly in the market. The significant resources of natural gas and a strong focus on minimizing dependence on hydropower increase demand for NGL. The growing demand for energy in industrial applications and the presence of unconventional shale gas increase the adoption of NGL. The growing development of NGL facilities and increasing investment in upstream operations drive the overall growth of the market.

Expanding Natural Gas Liquid Presence in Brazil

Brazil is growing at a substantial rate in the market. The strong presence of pre-salt reserves and power generation growth increases demand for NGL. The strong focus on strengthening energy security and diversification of energy supply increases demand for NGL. The rapid expansion of NGL import capacity supports the overall growth of the market.

Middle East & Africa Natural Gas Liquid Market Trends

The Middle East & Africa are growing in the market. The ample reserves of natural gas in nations like Nigeria, Saudi Arabia, & Iran, and large-scale investment in NGL petrochemical plants, help market expansion. The growing power generation push towards cleaner energy sources boosts demand for NGL. The major investment in NGL pipeline networks and ongoing NGL capacity expansion drives the overall market growth.

Top Market Players in the Natural Gas Liquid Market & Their Offerings:

- EnLink Midstream, LLC: Operates as a ONEOK subsidiary providing NGL gathering, processing, fractionation, and storage across major U.S. basins.

- Shell plc: Utilizes gas-to-liquids technology to convert natural gas into high-purity fuels, lubricants, and chemical feedstocks.

- TotalEnergies: Produces and markets NGLs and LPG globally while leading in liquefied natural gas (LNG) production.

- MPLX LP: Provides large-scale NGL gathering and fractionation services primarily in the Appalachian and Permian regions.

- Enterprise Products Partners L.P.: Operates a massive integrated NGL network for transportation, storage, fractionation, and global exports.

- ONEOK, Inc.: Manages one of the largest U.S. NGL systems, connecting supply basins to major market hubs via extensive pipelines.

- ExxonMobil Corporation: Produces NGLs from upstream assets to supply its global chemical and refining operations.

- Keyera Corp: Specializes in Western Canadian NGL infrastructure, providing storage, transportation, and marketing for propane and butane.

-

ConocoPhillips Company: Focuses on the upstream exploration and production of NGLs from its diverse global asset portfolio.

More Insights in Towards Chemical and Materials:

Industrial Gas Pipeline Infrastructure Market Volume to Hit USD 67.55 Mn Tn by 2034

Oil & gas infrastructure Market Size to Reach USD 1,377.87 Bn by 2034

Natural Gas Market Size to Reach USD 6.96 Trillion by 2034

Oil & Gas Market Size to Reach USD 8.79 Trillion by 2034

Gas Separation Membrane Market Size to Hit USD 3.62 Billion by 2034

Renewable Natural Gas Market Size to Hit USD 31.37 Bn by 2034

Biogas Market Size to Hit USD 265.60 Bn by 2035

Green Gas Market Size to Hit USD 3.96 Billion by 2035

Floating Liquefied Natural Gas (FLNG) Terminals Market Size to Hit USD 66.62 Bn by 2034

U.S. Oil & Gas Market Size to Hit USD 2.24 Trillion by 2034

U.S. Gas Pipeline Infrastructure Market Size to Hit USD 2,431.55 Bn by 2034

Asia Pacific Gas Pipeline Infrastructure Market Size to Surge USD 1,592.78 Bn by 2034

GCC Natural Gas Market Size to Hit USD 93.33 Billion by 2035

Europe Oil & Gas Infrastructure Market Size to Hit USD 140.09 Bn by 2034

Asia Pacific Oil & Gas Infrastructure Market Size to Reach USD 365.90 Bn by 2034

Asia Pacific Oil & Gas Market Size to Hit USD 2.79 Trillion by 2034

U.S. Oil & Gas Infrastructure Market Size to Hit USD 147.32 Billion by 2034

Natural Gas Liquid Market Top Key Companies:

- ExxonMobil Corporation

- Chevron Corporation

- Royal Dutch Shell plc

- BP plc

- ConocoPhillips

- TotalEnergies SE

- Enterprise Products Partners LP

- Eni S.p.A.

- Occidental Petroleum Corporation

- Saudi Aramco

- Gazprom

- Phillips 66

- ONEOK, Inc.

- Qatar Petroleum

- Williams Companies, Inc.

Recent Developments

- In December 2024, ExxonMobil announced to expand its NGL processing capacity by constructing a new fractionation plant in the Gulf Coast region to separate NGLs into ethane, propane, and butane, meeting growing petrochemical and export demand by first quarter of 2025. This initiative aims to strengthen ExxonMobil’s position as a leading NGL supplier, with an expected 20% increase in processing capacity and USD 500 million in annual revenue.

- In February 2025, Chevron announced to invest one USD billion to expand its NGL export infrastructure, including new storage facilities and loading terminals at key ports. This initiative aims to meet rising global demand, particularly in Asia and Europe. The expansion is expected to boost export volumes by 30%.

- In December 2025, the market player Saudi Aramco plans to start exporting condensate from the Jafurah gas Plant used in power generation in February 2026. This is the lead step to support domestic power needs and optimize the Kingdom's energy exports worldwide.

- In April 2025, Chevron U.S.A. Inc., A Chevron subsidiary, sold a 70% interest in its East Texas natural gas assets to TG Natural Resources for $525 million. This transaction lets Chevron focus on core strategic assets.

Natural Gas Liquid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Natural Gas Liquid Market

By Product Type

- Ethane

- Propane

- Normal Butane

- Isobutane

- Natural Gasoline (Pentane Plus)

By Source

- Natural Gas Processing Plants

- Crude Oil Refineries

By Application

- Petrochemical Feedstock

- Residential and Commercial Fuel (Heating & Cooking)

- Industrial Fuel and Processing

- Transportation Fuel (Autogas)

- Gasoline and Refinery Blendstock

- Aerosol Propellants and Refrigerants

By End-User

- Industrial Sector

- Residential Sector

- Commercial Sector

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6117

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.